We offer end to end financial services to our clients such as Personal Loan,Home Loan,Business Loan,Loan Against Property,Auto Loan,Machinary loan,Education Loan,Gold loan,Insurance,Investments and Credit Cards.

Assess Your Needs and Eligibility

Determine Loan Purpose: Identify why you need the loan, whether for business, education, medical expenses, or other purposes.

Check Eligibility: Review your financial situation, including income, credit score, and existing debts, to ensure you qualify for the loan.

Choose the Right Lender

Research Lenders: The Right Choice Jothi Finserv

Loan Types: Decide whether you need a mortgage, home equity loan, or a home equity line of credit.

Prepare Your Property Documents

Title Deed: Ensure you have the original title deed of the property.

Property Tax Receipts: Gather receipts of property tax payments.

Encumbrance Certificate: Obtain an encumbrance certificate to show the property is free of legal liabilities.

Building Plan Approval: If applicable, have the building plan approval from the local municipality.

No Objection Certificate (NOC): Get a NOC from the housing society or local authorities if needed.

Gather Personal and Financial Documents

Identification Proof: Passport, driver’s license, or any government-issued ID.

Address Proof: Utility bills, rental agreement, or Aadhaar card.

Income Proof: Salary slips, income tax returns, and bank statements.

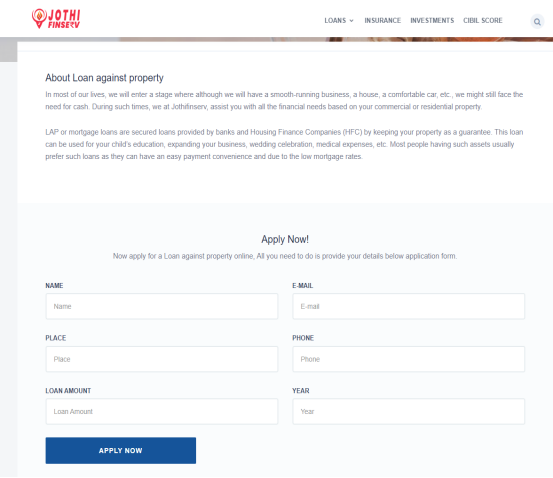

Apply for the Loan

Fill Out Application: Complete the lender’s loan application form accurately.

Submit Documents: Provide the necessary property and personal documents.

Property Valuation and Legal Verification

Property Valuation: The lender will appraise your property to determine its market value.

Legal Check: Our team will verify the authenticity of your property documents.

Loan Approval and Agreement

Loan Offer: If the valuation and legal checks are satisfactory, the lender will provide a loan offer detailing the loan amount, interest rate, tenure, and other terms.

Agreement Signing: Carefully review the loan agreement before signing.

Disbursement of Funds

Disbursement: After signing the agreement, the lender will disburse the loan amount to your account.

Tips for a Smooth Process

Maintain Good Credit: A higher credit score can help secure better loan terms.

Organize Documents: Keep all required documents in order and readily accessible.

Seek Professional Help: Consider hiring a financial advisor or loan consultant if you need assistance.

What is loan against property ?

A loan against property is a secured loan where an individual pledges their residential or commercial property as collateral to obtain funds from a lender. This type of loan allows the borrower to leverage the equity in their property to access substantial funds for various purposes such as business expansion, education, medical expenses, or other personal needs. The amount that can be borrowed is typically a percentage of the property’s current market value, determined through an appraisal process conducted by the lender. Because the loan is secured by real estate, lenders usually offer lower interest rates compared to unsecured loans. Borrowers must provide comprehensive documentation proving ownership and the legal status of the property, and the lender conducts both legal and valuation checks before approving the loan. Once approved, the borrower agrees to repay the loan in regular installments over a specified tenure. Failure to repay the loan can result in the lender seizing and selling the property to recover the outstanding amount.

What is the eligibility for loan against property ?

Eligibility for a loan against property typically includes several key criteria. Applicants must generally be between 21 and 60-70 years old, with self-employed individuals sometimes eligible up to 75 years. Both salaried and self-employed individuals need to demonstrate stable and sufficient income, with salaried individuals showing a few years of employment and self-employed individuals having a profitable business for at least three years. A good credit score, usually above 650, is important for securing favorable terms. The property offered as collateral must be residential or commercial, free from legal disputes, and have a clear, marketable title. Lenders usually provide loans up to 50-70% of the property’s market value, determined through a valuation process. Proper financial documentation, such as income proofs, bank statements, and tax returns, is also required. Meeting these criteria helps in securing a loan against property with favorable terms.

What are the documents required for loan against property ?

When applying for a loan against property, several documents are required to facilitate the approval process. These include personal identification documents such as a passport, driver’s license, or any government-issued ID, and address proofs like utility bills, rental agreements, or Aadhaar card. Income proof is essential, with salaried individuals needing to provide recent salary slips, Form 16, bank statements for the last six months, and income tax returns. Self-employed individuals must submit financial statements, bank statements for the last 12 months, and income tax returns for the past 2-3 years. Additionally, comprehensive property documents are necessary, including the original title deed, property tax receipts, an encumbrance certificate, and a no-objection certificate (NOC) from the housing society or local authorities if applicable. These documents ensure the property is free from legal issues and has a clear, marketable title. Providing these documents accurately and completely is crucial for the smooth processing and approval of the loan against property.

Jothi Finserv

Feel free to call our loan assist number 095005 75858