We offer end to end financial services to our clients such as Personal Loan,Home Loan,Business Loan,Loan Against Property,Auto Loan,Machinary loan,Education Loan,Gold loan,Insurance,Investments and Credit Cards.

Your CIBIL score significantly influences your eligibility for various loans. A score above 750 is ideal for home loans, enhancing your chances of approval and securing favorable terms. For personal loans, a score above 700 is generally preferred, though some lenders may approve lower scores with higher interest rates. Auto loans typically require a score of 700 or more for better rates and repayment options. Credit card issuers look for scores above 650, with premium benefits available for scores above 750. Business loans usually necessitate a score of 700 or higher. Maintaining a high CIBIL score ensures better loan approval odds and more advantageous terms.

CIBIL Score for Personal Loan

Your CIBIL score plays a crucial role in determining your eligibility for a personal loan. Generally, a CIBIL score of 700 or higher is considered good and significantly enhances your chances of loan approval. Here’s a detailed breakdown of how different CIBIL score ranges affect personal loan eligibility.

750 and Above: A score in this range is excellent and greatly increases your chances of loan approval. Lenders are likely to offer you lower interest rates and more favorable terms due to your strong creditworthiness.

700 to 749: A score in this range is considered good. Most lenders will approve your loan application, though the interest rates might be slightly higher compared to those with scores above 750.

650 to 699: This score range is considered fair. While some lenders may still approve your loan, you may face higher interest rates and less favorable terms. You might also be required to provide additional documentation or a guarantor.

600 to 649: A score in this range is considered below average. Your loan approval chances decrease, and those lenders who do approve your loan will likely charge significantly higher interest rates. Your loan terms may also be more stringent.

Below 600: A score below 600 is considered poor. Most lenders will be hesitant to approve your loan application, and those who do may impose very high interest rates and unfavorable terms. You might need to explore alternative lending options or focus on improving your credit score before reapplying.

CIBIL Score for Business Loan

Your CIBIL score is a key factor in determining your eligibility for a business loan. Lenders use this score to assess your creditworthiness and the risk associated with lending to you. Here’s how your CIBIL score affects your eligibility for business loans.

750 and Above: A CIBIL score of 750 or higher is excellent and significantly boosts your chances of getting a business loan approved. Lenders are likely to offer you the best interest rates and favorable loan terms, reflecting their confidence in your ability to repay the loan.

700 to 749: A score in this range is good and generally acceptable to most lenders. While you may not receive the absolute best interest rates, you are still likely to secure a business loan with reasonable terms.

650 to 699: This range is considered fair. While you can still obtain a business loan, the terms may not be as favorable, and the interest rates could be higher. Lenders might require additional documentation or collateral to mitigate the perceived risk.

600 to 649: Scores in this range are considered below average. Securing a business loan becomes more challenging, and the lenders willing to approve your application may charge higher interest rates and impose stricter terms. You might also need to provide substantial collateral or a co-signer.

Below 600: A score below 600 is considered poor. Your chances of getting a business loan are significantly reduced. Lenders view you as a high-risk borrower and may either reject your application or offer loans with very high interest rates and unfavorable terms. In such cases, you may need to look for alternative funding sources or work on improving your credit score before applying again.

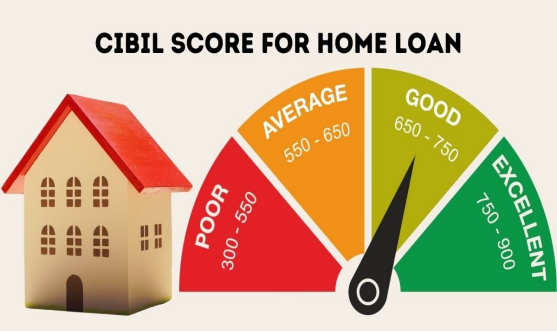

CIBIL Score for Home Loan

Your CIBIL score is a critical factor in determining your eligibility for a home loan. Here’s how different CIBIL score ranges impact your chances of getting a home loan.

750 and Above: A CIBIL score of 750 or higher is considered excellent. It significantly increases your chances of home loan approval. Lenders are more likely to offer you lower interest rates, higher loan amounts, and favorable terms and conditions due to your strong credit profile.

700 to 749: This range is considered good. Most lenders will approve your home loan application, although the interest rates might be slightly higher than those offered to individuals with scores above 750. The terms and conditions are still favorable, but you may not get the best possible rates.

650 to 699: A score in this range is considered fair. While you can still obtain a home loan, the interest rates may be higher, and the terms less favorable compared to those with higher scores. Lenders might require additional documentation or a higher down payment to mitigate risk.

600 to 649: This range is below average. Securing a home loan becomes more challenging, and lenders who do approve your application will likely charge higher interest rates and impose stricter terms. You may need to provide additional collateral or have a co-applicant with a better credit score.

Below 600: A score below 600 is considered poor. Your chances of getting a home loan are significantly reduced. Most lenders will view you as a high-risk borrower and may either reject your application or offer loans with very high interest rates and unfavorable terms. Improving your credit score before applying is advisable in this situation.

CIBIL Score for Car Loan

Your CIBIL score is a crucial determinant of your eligibility for a car loan. Here’s how different CIBIL score ranges impact your chances of getting a car loan.

750 and Above: A CIBIL score of 750 or higher is considered excellent and greatly enhances your chances of car loan approval. Lenders are likely to offer you the best interest rates, higher loan amounts, and favorable repayment terms due to your strong creditworthiness.

700 to 749: A score in this range is considered good. Most lenders will approve your car loan application and offer competitive interest rates, though not as low as those provided to individuals with scores above 750. The loan terms are generally favorable, making this a good range to be in.

650 to 699: This range is considered fair. You can still secure a car loan, but the interest rates may be higher and the terms less favorable compared to those with higher scores. Lenders may also require additional documentation or a larger down payment to reduce their risk.

600 to 649: A score in this range is below average. Getting a car loan becomes more challenging, and the lenders who do approve your application may offer higher interest rates and stricter terms. You might need to provide more substantial collateral or have a co-applicant with a better credit score to enhance your chances.

Below 600: A score below 600 is considered poor. Your chances of securing a car loan are significantly reduced. Most lenders will view you as a high-risk borrower, potentially rejecting your application or offering loans with very high interest rates and unfavorable terms. It’s advisable to work on improving your credit score before applying for a car loan in this situation.