We offer end to end financial services to our clients such as Personal Loan,Home Loan,Business Loan,Loan Against Property,Auto Loan,Machinary loan,Education Loan,Gold loan,Insurance,Investments and Credit Cards.

Applying for a car loan involves several key steps. First, assess your credit score, as it significantly impacts the loan terms you’ll qualify for. Next, research and compare lenders, including banks, credit unions, and online lenders, to find the best interest rates and loan terms. Once you’ve selected a lender, gather necessary documents such as proof of income, employment history, and identification. Fill out the loan application form, providing accurate personal and financial information. After submitting the application, the lender will review your creditworthiness and may require additional documentation. If approved, review the loan agreement carefully, ensuring you understand the interest rate, repayment schedule, and any fees. Once you agree to the terms, sign the loan documents and proceed with the purchase of your vehicle, using the loan funds provided by the lender.

Check Your Credit Score Your credit score affects your loan terms, so review it beforehand to understand your standing.

Research Lenders Compare offers from banks, credit unions, and online lenders to find the best interest rates and terms.

Gather Documents Collect necessary documents such as proof of income, employment history, identification, and possibly your credit report.

Complete the Application Fill out the loan application with accurate personal and financial details. This can often be done online, in person, or over the phone.

Submit the Application Provide the completed application and required documents to the lender. Be ready for the lender to ask for additional information if needed.

Review Loan Terms If approved, carefully read through the loan agreement, paying close attention to the interest rate, repayment schedule, and any fees.

Sign the Agreement If you agree to the terms, sign the loan documents. The lender will then release the funds for you to purchase your vehicle.

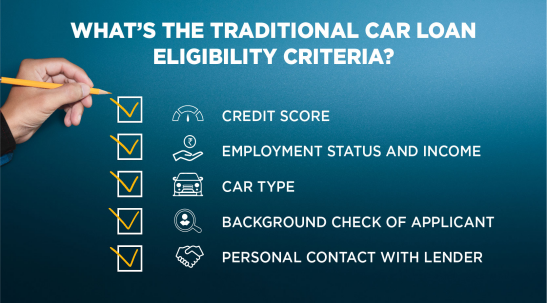

Eligibility Criteria for Car Loans

Eligibility criteria for car loans typically include several key factors. First, applicants need to have a good credit score, generally 600 or higher, as it influences loan approval and interest rates. Steady income and employment history are essential, with lenders usually requiring proof of income to ensure the borrower can make monthly payments. Additionally, applicants must be at least 18 years old and possess a valid driver’s license. Some lenders may have specific requirements regarding the vehicle, such as its age and condition, particularly if it’s a used car. Lastly, the debt-to-income ratio, which measures monthly debt payments against income, should fall within an acceptable range, typically below 40-50%, to demonstrate financial stability.

Effective Ways to Get a Low Second Hand Car Loan Interest rate?

To secure a low interest rate on a second-hand car loan, start by checking and improving your credit score, as a higher score can qualify you for better rates. Shop around and compare offers from various lenders, including banks, credit unions, and online lenders, to find the most competitive rates. Consider opting for a shorter loan term, which often comes with lower interest rates compared to longer terms. Making a larger down payment can also reduce the loan amount and the interest rate.

Additionally, getting Pre-approved for a loan can give you leverage when negotiating with dealers. Ensuring the car is relatively new and in good condition can also help, as lenders often offer better rates for well-maintained vehicles. Lastly, consider having a co-signer with strong credit, as this can improve your chances of securing a lower rate.

Keep Your Credit Score Mind

Try and Make a Significant Down Payment

Consider the Debt-to-Income Ration

Earn a Steady Income

Maintain a Good Relationship with Your Lender

Opting for a Short Repayment Tenure

Keep Your Credit Score Mind

Maintaining a good credit score is crucial for securing favorable loan terms, including lower interest rates on a second-hand car loan. Regularly monitor your credit report to ensure accuracy and address any errors promptly. Pay your bills on time, as timely payments significantly impact your score. Keep your credit card balances low relative to your credit limits, ideally below 30%, to demonstrate responsible credit usage. Avoid opening multiple new credit accounts in a short period, as this can negatively affect your score. Additionally, maintaining a mix of credit types, such as credit cards and installment loans, can positively influence your credit profile. By diligently managing your credit, you can enhance your chances of obtaining a low-interest rate on your car loan.

Try and Make a Significant Down Payment

Making a significant down payment on a second-hand car loan can greatly benefit your financial situation. By putting down a larger initial payment, you reduce the total loan amount, which in turn lowers the lender’s risk and can lead to a lower interest rate. This not only decreases your monthly payments but also reduces the overall interest you’ll pay over the life of the loan. A substantial down payment also improves your loan-to-value ratio, making you a more attractive borrower to lenders. Additionally, it can help you avoid being upside-down on your loan, where you owe more than the car’s value. Overall, a significant down payment can enhance your bargaining power and save you money in the long run.

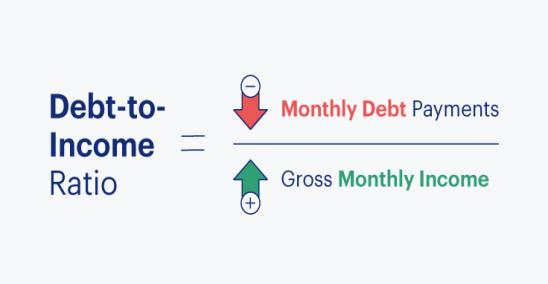

Consider the Debt-to-Income Ratio

When applying for a second-hand car loan, it’s important to consider your debt-to-income (DTI) ratio, which is the percentage of your monthly income that goes toward paying debts. Lenders use this ratio to assess your ability to manage additional debt responsibly. A lower DTI ratio, typically below 40-50%, signals to lenders that you have a healthy balance between debt and income, increasing your chances of securing a loan with favorable terms. To improve your DTI ratio, focus on paying down existing debts and avoiding new ones before applying for the car loan. By maintaining a low DTI ratio, you demonstrate financial stability and reliability, which can help you qualify for a lower interest rate on your car loan.

Earn a Steady Income

Earning a steady income is crucial when applying for a second-hand car loan, as it reassures lenders of your ability to make regular monthly payments. Consistent income demonstrates financial stability and reliability, key factors that lenders consider when assessing loan applications. To prove your income, you’ll typically need to provide recent pay stubs, tax returns, or bank statements. Having a steady job or stable business income also positively influences your debt-to-income ratio, further strengthening your loan application. In some cases, a longer tenure with your current employer can be beneficial, indicating job stability. By maintaining a reliable and steady income, you enhance your credibility as a borrower, increasing your chances of obtaining a favorable loan with a lower interest rate.

Maintain a Good Relationship with Your Lender

Maintaining a good relationship with your lender can be highly advantageous when applying for a second-hand car loan. Building trust and a positive history with your lender can make them more willing to offer favorable terms, such as lower interest rates and flexible repayment options. Regularly communicating with your lender and keeping them informed about your financial situation can foster this relationship. Timely payments on existing loans or accounts with the lender also demonstrate your reliability and financial responsibility. If you have a long-standing relationship with a bank or credit union, they may be more likely to consider your entire financial history, rather than just your credit score, when evaluating your loan application. By cultivating a strong, positive relationship with your lender, you can enhance your chances of securing better loan terms for your car purchase.

Opting for a Short Repayment Tenure

Opting for a short repayment tenure can be a strategic move when securing a second-hand car loan. While longer loan terms may seem attractive due to lower monthly payments, they often come with higher overall interest costs. In contrast, choosing a shorter repayment period can lead to significant savings in interest payments over the life of the loan. Additionally, lenders typically offer lower interest rates for shorter loan terms, further reducing the total cost of borrowing. A shorter repayment tenure also means you’ll own the car outright sooner, providing financial freedom and flexibility. However, it’s essential to ensure that the monthly payments fit within your budget comfortably. By selecting a shorter repayment tenure, you not only save money on interest but also pay off your loan faster, ultimately achieving financial freedom sooner.